shelby07n3637

About shelby07n3637

Personal Loans with No Credit Score Test: A Financial Lifeline or A Dangerous Gamble?

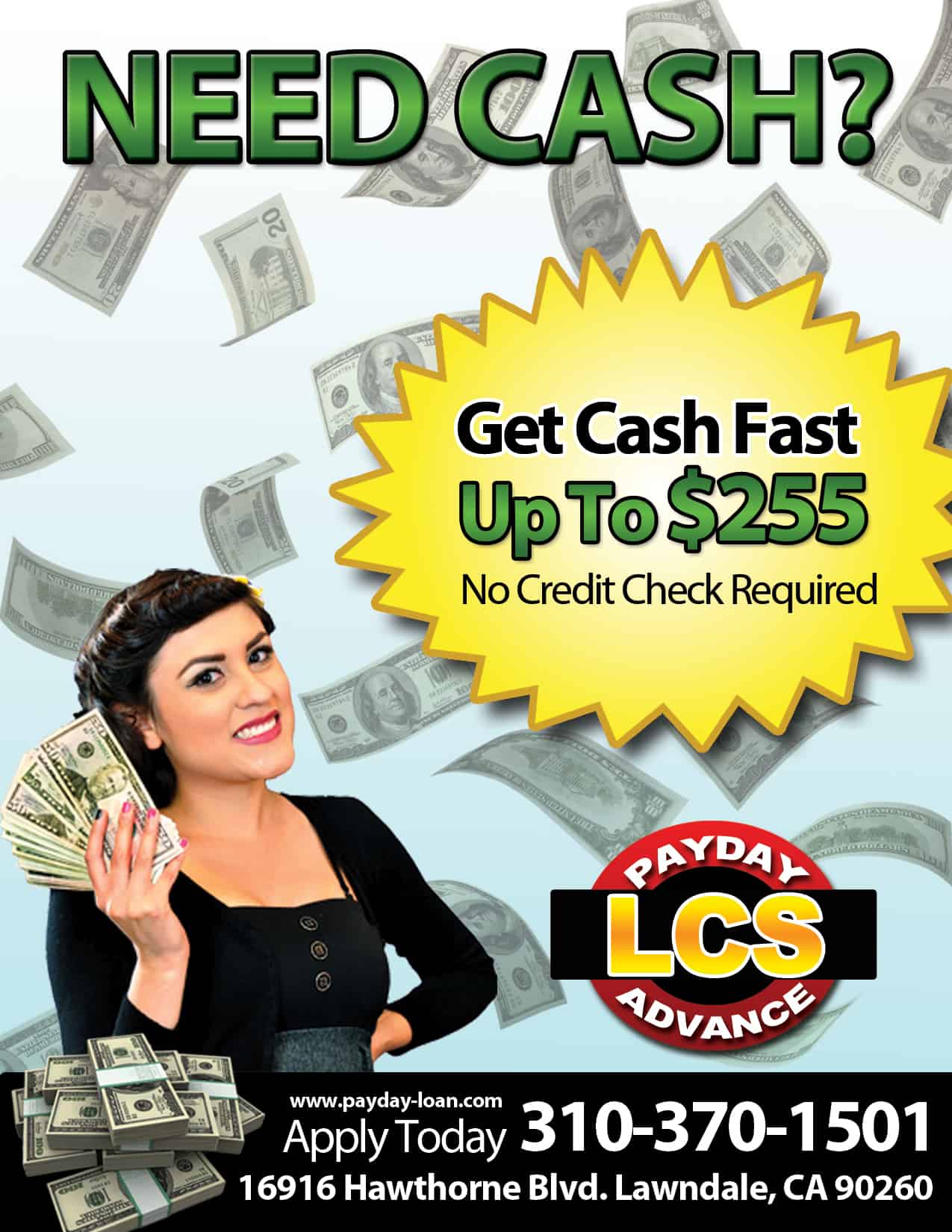

In at present’s fast-paced world, financial emergencies can strike at any second. Whether or not it is an unexpected medical invoice, car repair, or residence upkeep challenge, many individuals discover themselves in need of quick money. For those with much less-than-excellent credit score scores, traditional lenders often present a daunting challenge. However, the rise of private loans with no credit examine has emerged as a possible resolution for people seeking quick financial relief. But is this option actually a monetary lifeline, or does it include hidden dangers?

Understanding Personal Loans with No Credit Test

Personal loans with no credit check are financial products that enable borrowers to entry funds with out undergoing the normal credit evaluation course of. This means that lenders do not assess the borrower’s credit history or credit rating when figuring out eligibility. Instead, these loans usually depend on various standards, reminiscent of income verification, employment standing, and bank account info.

The Attraction of No Credit Check Loans

For many, the appeal of no credit examine loans is obvious. People with poor credit histories or those that haven’t established credit might discover it challenging to safe loans from standard monetary institutions. By eliminating credit score checks, these lenders provide an opportunity for borrowers to acquire funds rapidly and effectively.

Furthermore, the appliance process for no credit score check loans is usually streamlined and person-friendly. Many lenders supply online purposes that can be accomplished in minutes, with funds deposited immediately into the borrower’s checking account inside a short timeframe, often within 24 hours.

Who Can Benefit from No Credit score Examine Loans?

No credit score test loans will be notably helpful for particular groups of individuals, together with:

- People with Poor Credit: These who have faced monetary difficulties prior to now, resulting in low credit scores, might discover it practically not possible to secure conventional loans. No credit score verify loans offer a chance to entry funds with out the stigma of a poor credit historical past.

- Younger Adults: Individuals who’re new to credit and haven’t yet established a credit score history may additionally profit from these loans. They may help younger borrowers construct a monetary historical past while addressing immediate wants.

- Self-Employed People: Freelancers and self-employed individuals usually face challenges in proving their income stability. No credit score verify loans can provide a lifeline for those who may struggle to obtain financing by way of conventional means.

The Risks Involved

Whereas no credit score check loans can provide immediate monetary relief, they don’t seem to be with out risks. Borrowers ought to be aware of the potential downsides earlier than committing to such loans:

- Higher Curiosity Rates: One of many most important drawbacks of no credit check loans is the typically exorbitant curiosity charges. Lenders who do not assess credit threat usually compensate for this by charging greater charges, which might lead to a cycle of debt if borrowers are unable to repay on time.

- Shorter Repayment Terms: Many no credit score examine loans come with shorter repayment periods, which may create pressure on borrowers to repay shortly. This may lead to monetary pressure, especially if the borrower is already in a precarious financial state of affairs.

- Threat of Predatory Lending: The lack of regulation in the no credit verify loan market can lead to predatory lending practices. Some lenders could target susceptible individuals with deceptive phrases, hidden fees, or aggressive assortment techniques.

Making Informed Choices

For these considering a private loan with no credit score examine, it is essential to method the choice with caution. Here are some ideas to help navigate the method:

- Research Lenders: Not all lenders offering no credit score test loans are created equal. If you have any inquiries concerning exactly where and how to use $50 000 loan with no credit check (bestnocreditcheckloans.com), you can make contact with us at the web site. It is essential to research potential lenders thoroughly, in search of opinions and rankings from earlier borrowers. Choose respected lenders with transparent terms and situations.

- Examine Rates and Phrases: Earlier than committing to a mortgage, compare interest charges, charges, and repayment phrases from multiple lenders. This will help guarantee that you simply secure the very best deal.

- Learn the Effective Print: Always read the mortgage settlement rigorously. Search for any hidden charges, prepayment penalties, or different terms that could impact your repayment.

- Consider Alternate options: Earlier than choosing a no credit verify loan, discover different financing choices. This might include seeking assistance from family or friends, negotiating fee plans with creditors, or considering credit score unions that may supply more favorable phrases.

- Plan for Repayment: Should you decide to take out a no credit test mortgage, create a clear repayment plan. Budget for the mortgage funds to avoid falling behind and incurring further fees or penalties.

Conclusion

Private loans with no credit check can provide a worthwhile resource for individuals going through monetary emergencies. They provide a quick and accessible method to secure funds with out the boundaries of conventional credit assessments. Nonetheless, borrowers must stay vigilant and informed in regards to the potential dangers related to these loans. By conducting thorough analysis, evaluating options, and planning for repayment, people could make knowledgeable monetary choices that align with their wants and circumstances. Finally, whereas no credit check loans can function a financial lifeline, they require careful consideration and responsible management to avoid the pitfalls of high-interest debt.

No listing found.